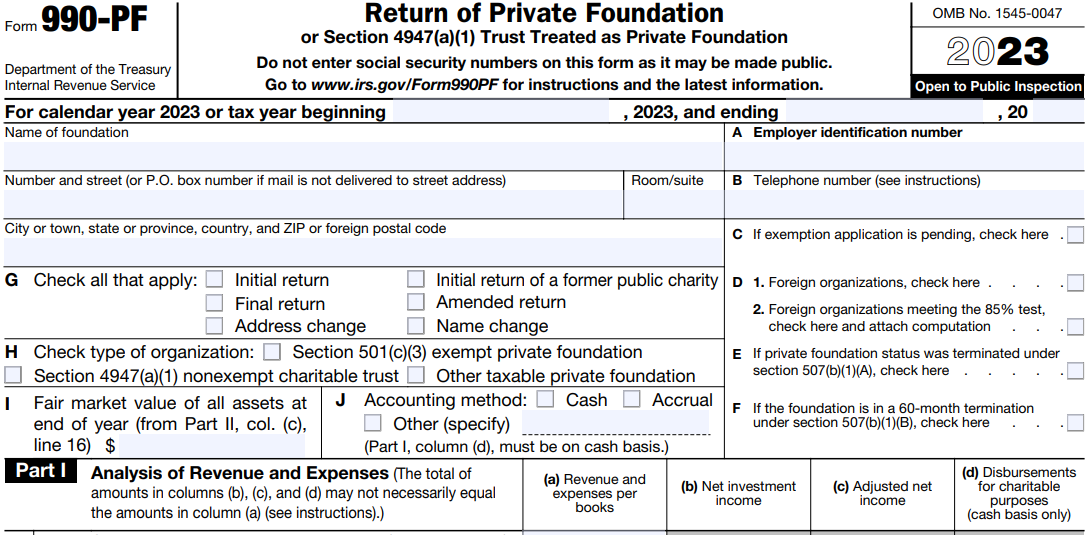

Form 990-PF is used to calculate the taxes based on investment income, and to report charitable distributions and activities. Also, Form 990-PF serves as a substitute for Form 1041, U.S. Income Tax Return for Estates and Trusts, when the trust has no taxable income, section 4947(a)(1) nonexempt charitable trust's income tax return.

Visit https://www.expresstaxexempt.com/form-990-pf/what-is-form-990-pf/ to learn more about

Form 990-PF.

The IRS requires some additional information about contributions like money, securities, or other property which is worth at least $5,000 to be reported on

Form 990-PF Schedule B.

“Private foundations are required to spend annually a certain amount of money or property for charitable purposes, including grants to other charitable organizations. A private foundation must make its annual returns and exemption application available for public inspection.”

Form 990-PF is an annual information return that must be filed by the following foundations.

Private Foundations that operates on a calendar tax year (January 1 to December 31) should file their 990-PF return on or before May 15.

Private Foundation that operates on a fiscal tax year should file Form 990-PF before the 15th day of the 5th month following the organization's tax year-end date.

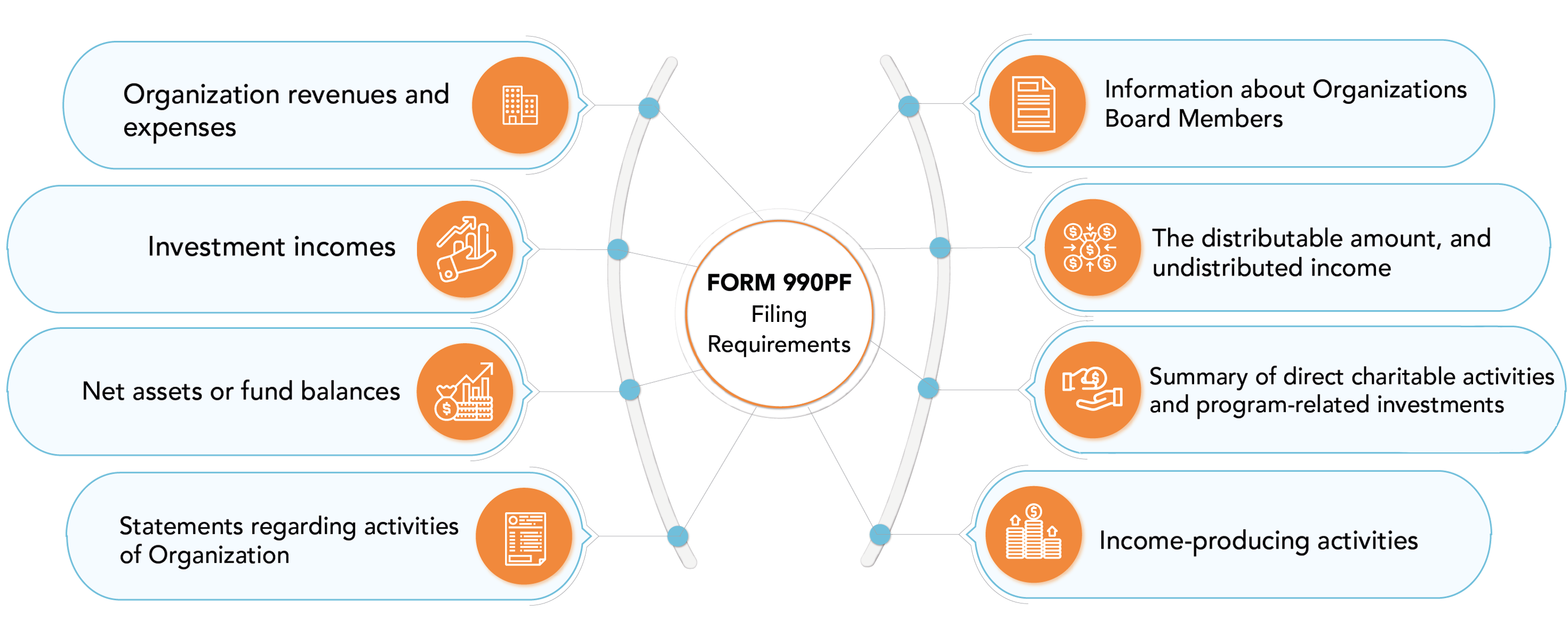

Here we have listed the few information required to file Form 990-PF:

Ready to File Form 990-PF?

E-File Form 990-PF NowForm990pf.com is powered by Tax 990 the leading E-file provider of Form 990-PF. Tax 990 makes the filing of Form 990-PF very easy and secure. The following are the highlights of Tax 990:

Ready to Get Started with Form990PF.com?

Access to Chat, Email, and Phone Support

If you need more time to file your Form 990-PF, you can request IRS

by Filing Form 8868.

IRS doesn’t require any explanation to file

Form 8868.

IRS provides an automatic 6 months additional time to file your 990-PF return.

The IRS will impose a late filing penalty of $20/day ($105 a day if it is a large organization) for the Organizations gross receipts are less than $1,000,000 for the tax year and doesn’t provide any reasonable cause for late filing.

Failing to file Form 990-PF for three consecutive years will result in an automatic revocation of the tax-exempt status.